416 Blair Ave,

Reading, PA 19601

2024 Marketing Trends for Financial Advisory Firms

Financial Advisors Services is a competitive and regulated industry. The cost per customer acquisition is high, and encouraging customers will continue to be challenging with more competitors and alternative solutions for clients. Financial advisor marketing must continue to tweak their marketing strategies to align with their customers’ motivations to achieve their financial goals.

Growing and maintaining your clientele will NOT get any easier in the future. Based on the U.S. Bureau of Labor Statistics, employment of personal financial advisors is projected to grow 13 percent from 2022 to 2032, much faster than the average for all occupations. About 25,600 openings for personal financial advisors are projected each year, on average, over the decade. Many of those openings are expected to result from replacing workers who transfer to different occupations or who exit the labor force, such as via retirement.

Here are the financial advisors marketing strategies that financial advisory firms should be paying attention to:

Personalization and Customer Experience for Financial Advice

Tailoring marketing efforts to individual customer preferences and behaviors was already crucial. Your ideal client will need different financial advice depending on their life stage or motivation. For example, a recent grad will need advice for early-stage retirement planning.

Advanced analytics, AI, and machine learning will be used to create personalized experiences. It includes offering relevant products such as estate planning and enhancing customer journeys. We see analytics and AI being used with dynamic content and paid advertising campaigns.

Video Marketing and Webinars to Convert Prospects

Video content continued to gain traction. Financial advisors will continue to use videos for client education, market updates, and hosting webinars to engage with both existing and prospective clients.

91% of consumers want to see more online videos from brands. (HubSpot)

Financial professionals can use seminar footage for video marketing to attract potential clients. This allows you to use traditional marketing tactics and transition to digital marketing to connect with prospects outside of your geographic area but still in your niche.

Client-Centric Approach and Relationship Building for a Profitable Future

Financial Planners are prioritizing personalized client experiences by leveraging technology for tailored communication and services. Building and nurturing client relationships through regular communication, education, and personalized advice remained crucial.

You'll hear the phrase, omnichannel marketing associated with a client-centric approach. Smart Insights defines it as "Omnichannel means planning and optimizing always-on and campaign-focused marketing communications tools across different customer lifecycle touchpoints to maximize leads and sales - all the while delivering a seamless customer experience to encourage customer loyalty"

It's a wide range of marketing tactics such as search engine optimization and a lot more. The bottom line is a better user experience, increased brand awareness for your types of financial services, and increased revenues.

Utilization of CRM and Marketing Automation For Better Results

Customer Relationship Management (CRM) systems, sales automation, and marketing automation tools were being used to streamline client communications, manage leads, and personalize interactions. Automated processes freed up time for advisors to focus on high-value activities.

Marketers who use a CRM are 128% more likely to say their marketing strategy this year was very effective compared to those who don't. (HubSpot Blog Marketing Trends Report, 2024)

CRM systems play a pivotal role in helping financial advisors streamline operations, improve client relationships, segment clients and ultimately grow your business by delivering more personalized and efficient services.

For example, wealth managers can keep track of important deadlines, appointments, and tasks related to client servicing. This ensures that no critical tasks or client interactions are missed.

There are several options such as HubSpot, Wealthbox, Salesforce, and Redtail.

Focus on Niche Markets and Specialized Services to Stand Out

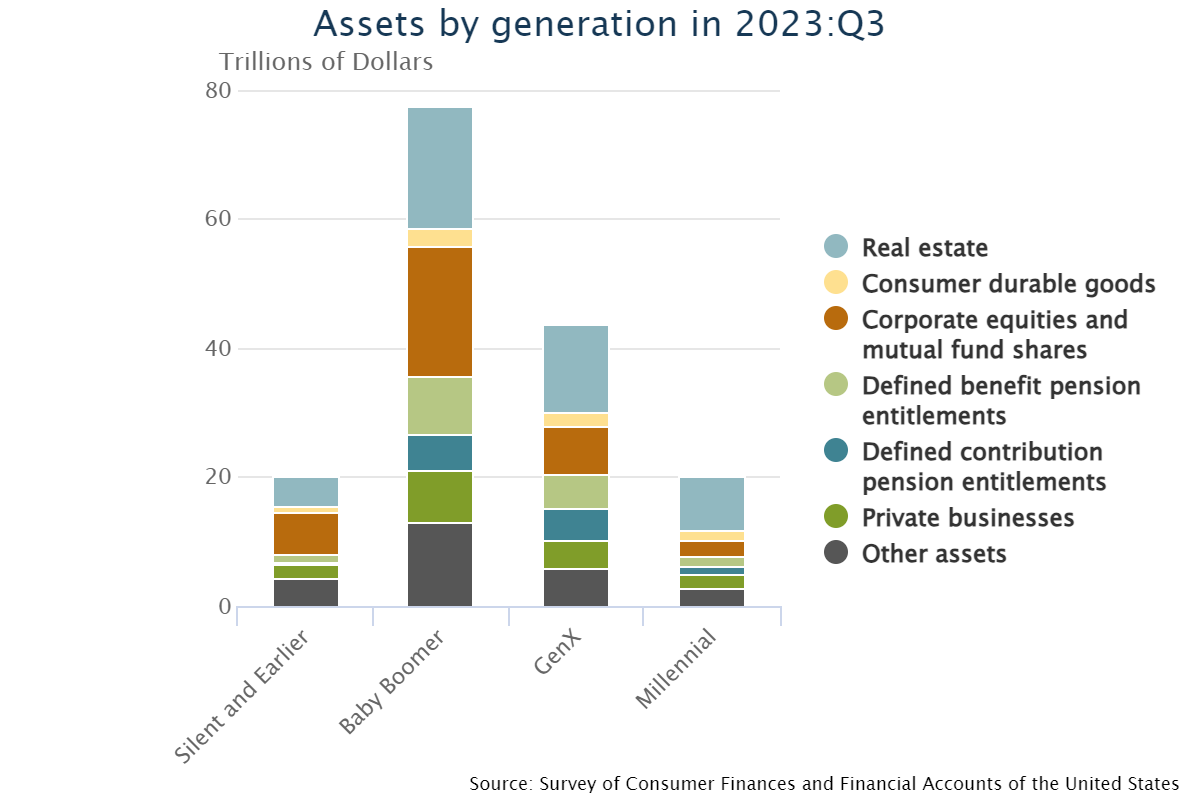

Advisors were identifying and targeting specific niche markets or specialized services to differentiate themselves in a competitive landscape and wealth transfer. According to wealth management firm Cerulli Associates, some $53 trillion will be passed down from boomers to their Gen X, millennial, and Gen Z heirs, as well as to charities.

There are some options to focus on when you consider niche, services, wealth transfer, and your firm area of expertise. For example, divorce financial planning for women and wealth management for physicians.

Firms specializing in divorce financial planning assist individuals in navigating the financial complexities of divorce. They help with asset division, alimony, child support, and long-term financial planning post-divorce.

Financial consultants might specialize in serving healthcare professionals, such as doctors, dentists, or veterinarians, who often have unique financial needs due to their specific career paths, high earning potential, and complex compensation structures.

Put a Marketing Plan in Place to Take Advantage of the Trends

The financial advisor industry is constantly evolving and becoming more competitive. With the projected growth in employment and the rise of alternative solutions for clients, it will only become more challenging to attract and retain customers. However, by understanding your customers' motivations and utilizing effective marketing strategies such as personalization and video marketing, you can set yourself apart from the competition. Remember to focus on niche markets and use CRM and marketing automation to better connect with your target audience.

By taking these steps now, you can position yourself for success in the future. So don't wait any longer - put a comprehensive marketing plan in place that incorporates these trends and techniques to effectively grow your clientele. As a trusted financial advisor, it's up to you to stay ahead of the game and provide your clients with personalized, client-centric services that will help them achieve their financial goals. The time to act is now so go out there and make an impact!

Subscribe to our Blog

Recent Posts

Categories

- Marketing Strategy (126)

- web design (81)

- digital marketing (70)

- Search Engine Optimization (SEO) (61)

- Paid Search (PPC) (59)

- Digital Analytics (54)

- seo (49)

- Google Analytics (48)

- News & Events (48)

- Social Media Marketing & Management (45)

- Content Marketing (43)

- PPC (43)

- Ecommerce & Retail Marketing (39)

- Business to Business Marketing (33)

- Mobile marketing (33)

- Website design (31)

- eCommerce (31)

- local seo (30)

- Inbound marketing (29)

- social media (26)

- email marketing (25)

- social media marketing (25)

- B2B (23)

- B2B marketing (23)

- website redesign (22)

- website development (20)

- Financial Services (19)

- Pay Per Click (19)

- SEO strategy (19)

- marketing (19)

- B2B marketing agency (18)

- web development (18)

- Google AdWords (17)

- press release (16)

- ecommerce marketing (15)

- social media strategy (15)

- Social Media Management (14)

- content (14)

- marketing automation (14)

- sales (13)

- web design services for small business (13)

- Digital Branding (12)

- Video Marketing (12)

- branding (12)

- lead generation (12)

- Analytics (11)

- Artificial intelligence (AI) (11)

- Retail Marketing (11)

- SEM (11)

- digital advertising (11)

- increase brand awareness (11)

- internet marketing (11)

- online shopping (11)

- search engine optimization (11)

- web analytics (11)

- Healthcare & Wellness (10)

- Lead Generation Marketing (10)

- SEO Services (10)

- Social Strategy (10)

- Web Design Strategy/Website Strategy (10)

- Web Design Trends (10)

- local listing management (10)

- responsive web design (10)

- CRM (9)

- Inbound Marketing Strategies (9)

- WordPress (9)

- content development (9)

- content strategy (9)

- financial services marketing (9)

- 2024 Planning (8)

- Bank Marketing (8)

- Content Planning (8)

- Google Ads (8)

- PPC Marketing (8)

- Retail Sales (8)

- Shopify (8)

- Web Security (8)

- b2b sales (8)

- financial advisors marketing (8)

- project management (8)

- redesign website (8)

- social marketing (8)

- social media analytics (8)

- strategic marketing (8)

- web designer (8)

- 2025 Planning (7)

- AdWords (7)

- Bing Ads (7)

- Mobile design (7)

- Sales Strategy (7)

- Social Media Metrics (7)

- brand identity (7)

- business strategy (7)

- content optimization (7)

- link building (7)

- mobile (7)

- mobile website (7)

- ppc advertising (7)

- social tips (7)

- website (7)

- AI Content (6)

- CMS (6)

- Customer Persona (6)

- Healthcare Marketing (6)

- Link Earning (6)

- Online Sales (6)

- ROI (6)

- SEO measurement (6)

- Search Engine Marketing (6)

- account-based marketing (6)

- brand development (6)

- digital marketing agency (6)

- digital marketing strategy (6)

- financial marketing (6)

- hubspot cms (6)

- measurement (6)

- news and events (6)

- shopify website (6)

- shopping ads (6)

- small business (6)

- social analytics (6)

- strategy (6)

- B2C Marketing (5)

- Home Services (5)

- SEO Agency (5)

- brand guidelines (5)

- business to business (5)

- customer relationship management (5)

- customer relationship management tools (5)

- google shopping (5)

- hubspot agency (5)

- inbound marketing strategy (5)

- keyword research (5)

- lead generation website (5)

- marketing insights (5)

- marketing tips (5)

- paid search campaigns (5)

- ppc management (5)

- sales CRM (5)

- user experience (5)

- video (5)

- Artificial Intelligence (4)

- CMS Hub (4)

- Call Tracking (4)

- Facebook (4)

- Improve productivity (4)

- Inbound Sales Strategy (4)

- KPIs (4)

- Local Listings (4)

- Logo Design (4)

- Non-Profit Marketing (4)

- Outbound Sales Strategy (4)

- Paid Search (4)

- Plumbing Marketing (4)

- SERPS (4)

- Uncategorized (4)

- Wealth Management marketing (4)

- conversions (4)

- creative design (4)

- customer relationship system (4)

- dabrian marketing (4)

- data (4)

- ecommerce SEO (4)

- email (4)

- leads (4)

- measuring SEO (4)

- mobile advertising (4)

- news (4)

- optimization (4)

- paid online advertising (4)

- sales funnel (4)

- sales pipeline (4)

- security (4)

- smart goals (4)

- social advertising (4)

- tag management (4)

- trends (4)

- web developer (4)

- 2023 (3)

- Adobe Analytics (3)

- Amazon Advertising (3)

- Automotive Marketing (3)

- B2B Content (3)

- B2B Search Marketing (3)

- B2B eCommerce (3)

- B2C (3)

- Continuous Website Improvement (3)

- Google My Business (3)

- Growth Driven Design (3)

- Hospital Marketing (3)

- Insurance Marketing (3)

- Lawn Care Marketing (3)

- LinkedIn (3)

- Marketing Budgeting (3)

- Measurement Planning (3)

- Multivariate Testing (3)

- Online Business (3)

- Organic Search (3)

- Partnership (3)

- Personas (3)

- Product Inventory (3)

- SEO Reporting (3)

- SOCIAL ECOMMERCE (3)

- Sales Prospecting (3)

- Sales and Marketing Alignment (3)

- Social media updates (3)

- Time Management (3)

- Twitter (3)

- UX Design (3)

- UX research (3)

- adCenter (3)

- advertising (3)

- api (3)

- attribution modeling (3)

- big data (3)

- compliance (3)

- construction marketing (3)

- consumer services (3)

- credit union (3)

- customer (3)

- digital content (3)

- digital marketing measurement (3)

- digital marketing services (3)

- email for ecommerce (3)

- facebook ads (3)

- google partners connect (3)

- graphic design (3)

- home improvement (3)

- hubspot (3)

- hubspot crm (3)

- hubspot sales (3)

- instagram (3)

- local search (3)

- minority owned businesses (3)

- monitor (3)

- omnichannel Marketing (3)

- online reputation management (3)

- online store (3)

- paid search advertising (3)

- pay per click advertising campaigns (3)

- ppc account management (3)

- reputation management (3)

- social media tips (3)

- tips (3)

- voice search (3)

- #agencylife (2)

- 2022 (2)

- 2023 planning (2)

- 2024 (2)

- 2026 planning (2)

- ABM (2)

- BigCommerce (2)

- Business growth opportunities (2)

- COVID (2)

- Covid-19 (2)

- Facebook Tips (2)

- Facebook business (2)

- GDPR (2)

- Gmail tips (2)

- Google Business Profile (2)

- Google event (2)

- Home Improvement Marketing (2)

- LinkedIn Ads (2)

- Minority Business Enterprise (2)

- Online Advertising (2)

- Product Data Feed (2)

- Qualitative Data (2)

- Restaurant Marketing (2)

- SBE (2)

- Twitter Tips (2)

- UX (2)

- Video SEO (2)

- Yelp (2)

- ad copy (2)

- aeo (2)

- agency transparency (2)

- automated bidding (2)

- bank advertising (2)

- budget (2)

- business growth (2)

- certification (2)

- client appreciation (2)

- clients (2)

- cloud (2)

- communication (2)

- content promotion (2)

- copywriting (2)

- data driven culture (2)

- data mining (2)

- data privacy (2)

- design (2)

- digital avertising (2)

- digital transformation (2)

- digital vs traditional (2)

- education (2)

- email analytics (2)

- email marketing measurement (2)

- enhanced campaigns (2)

- guide (2)

- home services marketing (2)

- hootsuite (2)

- hosting services (2)

- implementing (2)

- inbound leads (2)

- inbound success plan (2)

- industries (2)

- industry solutions (2)

- interactive content (2)

- internet (2)

- landing (2)

- landing page (2)

- lead generation tools (2)

- lehigh valley (2)

- local business (2)

- local event (2)

- local listing (2)

- logo types (2)

- manufacturing marketing (2)

- marketing metrics (2)

- marketing tools (2)

- measure (2)

- mobile analytics (2)

- mobile app (2)

- mobile optimization (2)

- mobile seo (2)

- multichannel (2)

- multichannel marketing (2)

- native ads (2)

- news release (2)

- non-profit (2)

- nonprofit marketing (2)

- on-page seo (2)

- one page web design (2)

- operations process (2)

- outbound marketing (2)

- phone calls (2)

- platform (2)

- plumbing (2)

- rackspace (2)

- reading pa (2)

- remarketing (2)

- retargeting (2)

- sales enablement (2)

- sales plan (2)

- segmentation (2)

- self marketing (2)

- social (2)

- social commerce (2)

- social media agency (2)

- staffing and recruitment (2)

- successful (2)

- target audience (2)

- tariffs (2)

- technical seo (2)

- testing (2)

- tracking (2)

- universal analytics (2)

- website optimization (2)

- work platforms (2)

- workflows (2)

- 1 page sales plan (1)

- 2021 (1)

- 2022 planning (1)

- 5 basic principles (1)

- AAF (1)

- AAF-GLV (1)

- Alignment (1)

- American Advertising Federation (1)

- American Advertising Federation Greater Lehigh Val (1)

- AuthorRank (1)

- B2B growth (1)

- Backlinks (1)

- Brightlocal (1)

- CRM alignment (1)

- Cheap SEO Services (1)

- Cloud U (1)

- Cold Calls (1)

- Cold Email (1)

- Cold Outreach (1)

- Conversion Tracking (1)

- Copywriter (1)

- Display Advertising (1)

- Dynamic Text (1)

- GK Elite (1)

- General (1)

- Google Guidelines (1)

- Google Rankbrain (1)

- Google Rankings (1)

- Google reviews (1)

- Google+ (1)

- Hospitality & Travel (1)

- Hubspot Onboarding (1)

- Landscaping Marketing (1)

- Legal advice (1)

- Load-Time (1)

- MBE (1)

- MWBE (1)

- Microsoft adCenter (1)

- Millennials (1)

- ODYSSEY Battery (1)

- Pest Control Marketing (1)

- Pipedrive (1)

- Programmatic Advertising (1)

- Project Management Systems (1)

- Quality Score (1)

- ROAS (1)

- SEO strategy in 2015 (1)

- Sales Calls (1)

- Shopify partner (1)

- Soc (1)

- Toptrends (1)

- URL Structure (1)

- URL tagging (1)

- User Behavior (1)

- VeteransDay (1)

- Woocommerce (1)

- accessibilitiy (1)

- accessibility (1)

- accounts (1)

- administrative (1)

- advisor efficiency (1)

- algorithm management (1)

- align (1)

- analytics framework (1)

- artisanal cheese (1)

- attribution (1)

- audience segmentation (1)

- authorship (1)

- auto dealers (1)

- b2b buying habits (1)

- bidding strategy (1)

- blog (1)

- bounce rate (1)

- brand culture (1)

- bug (1)

- business (1)

- business plan (1)

- business systems (1)

- business tech (1)

- buyer's journey (1)

- buying process (1)

- campaign tagging (1)

- campaign tracking (1)

- candidate marketing (1)

- capturing (1)

- cause marketing (1)

- citations (1)

- click-and-mortar (1)

- column hack (1)

- combination marks (1)

- competitor analysis (1)

- competitor research (1)

- content hub (1)

- content syndication (1)

- conversion (1)

- cost data (1)

- cpa (1)

- cpc (1)

- crowdsourced marketing (1)

- crowdsourcing (1)

- customer segments (1)

- cyber monday (1)

- daa symposium (1)

- data driven marketing (1)

- dental marketing (1)

- desktop design (1)

- don draper (1)

- downtown improvement district (1)

- efforts (1)

- election (1)

- email campaigns (1)

- email design (1)

- email guidelines (1)

- email organizing tips (1)

- emblems (1)

- engagement (1)

- enterprise search (1)

- event (1)

- event sponsorship (1)

- exact (1)

- expansion (1)

- experiments (1)

- free website (1)

- ga (1)

- geo (1)

- gmail tricks (1)

- google authorship (1)

- greater lehigh valley chamber of commerce (1)

- growth strategies (1)

- heartbleed (1)

- hiring (1)

- hubspot content hub (1)

- hubspot solutions partner (1)

- icons (1)

- increase (1)

- infographic (1)

- insurance and trust (1)

- integrated marketing (1)

- integration (1)

- inventory file (1)

- kerning (1)

- keyword match types (1)

- keywords (1)

- law firm (1)

- law firm marketing (1)

- law practice (1)

- legal services (1)

- letter marks (1)

- life science (1)

- logo creation (1)

- logos (1)

- mad men (1)

- maintenance (1)

- marketing attribution (1)

- marketing event (1)

- marketing for law (1)

- marketing hub (1)

- medical marketing (1)

- meetings (1)

- member insights (1)

- metrics (1)

- mobile banking (1)

- multitasking (1)

- myth (1)

- new (1)

- new hire (1)

- new year's resolution (1)

- newhire (1)

- nonprofit (1)

- office (1)

- one page website (1)

- online marketing (1)

- opportunity house (1)

- outdated (1)

- pages (1)

- parallax scrolling (1)

- partner (1)

- personalization (1)

- pharma marketing (1)

- pharmaceutical (1)

- pitfalls (1)

- pivot tables (1)

- predictive marketing (1)

- privacy (1)

- problem planning (1)

- product feed (1)

- productivity (1)

- project manager (1)

- project mgmt system (1)

- projects (1)

- prospects (1)

- quality (1)

- rank higher (1)

- recruiting (1)

- regulated (1)

- relations (1)

- remote workspace (1)

- return on ad spend (1)

- reviews (1)

- rich snippets (1)

- robo advisors (1)

- sales automation (1)

- sales enablement tools (1)

- sales goals (1)

- say cheese reopening (1)

- schema markup (1)

- search engines (1)

- search rankings (1)

- seocial (1)

- sequences (1)

- single page website (1)

- snap map (1)

- snapchat (1)

- snapchat business (1)

- snapchat tips (1)

- social media marketing agencies (1)

- social media tools (1)

- social monitoring (1)

- socialytics (1)

- storytelling (1)

- superiors (1)

- supply chain (1)

- symbols (1)

- tag management solution (1)

- tagline development (1)

- task management (1)

- team (1)

- thankyouforyourservice (1)

- time blocking (1)

- traditional marketing (1)

- tutorial (1)

- twitter business (1)

- user experience research (1)

- video production (1)

- video strategy (1)

- virtual reality (1)

- visibility (1)

- volunteerism (1)

- webinar (1)

- website updates (1)

- white paper (1)

- word marks (1)

- work from home (1)

- work tools (1)

- yahoo mail (1)

Archives

- April 2025 (8)

- July 2025 (8)

- December 2025 (8)

- September 2012 (7)

- August 2015 (6)

- February 2016 (6)

- July 2016 (6)

- January 2017 (6)

- May 2017 (6)

- June 2025 (6)

- October 2025 (6)

- May 2012 (5)

- April 2013 (5)

- May 2013 (5)

- June 2013 (5)

- July 2013 (5)

- July 2014 (5)

- October 2014 (5)

- January 2015 (5)

- July 2015 (5)

- October 2015 (5)

- May 2016 (5)

- June 2016 (5)

- October 2016 (5)

- March 2017 (5)

- April 2017 (5)

- April 2022 (5)

- May 2022 (5)

- June 2022 (5)

- November 2022 (5)

- February 2024 (5)

- July 2024 (5)

- October 2024 (5)

- March 2025 (5)

- September 2025 (5)

- November 2025 (5)

- June 2011 (4)

- April 2012 (4)

- June 2012 (4)

- July 2012 (4)

- August 2012 (4)

- October 2012 (4)

- November 2012 (4)

- January 2013 (4)

- February 2013 (4)

- September 2013 (4)

- October 2013 (4)

- March 2014 (4)

- June 2014 (4)

- August 2014 (4)

- September 2014 (4)

- November 2014 (4)

- March 2015 (4)

- May 2015 (4)

- June 2015 (4)

- January 2016 (4)

- August 2016 (4)

- September 2016 (4)

- November 2016 (4)

- December 2016 (4)

- June 2017 (4)

- March 2018 (4)

- December 2018 (4)

- May 2019 (4)

- January 2021 (4)

- April 2021 (4)

- October 2021 (4)

- December 2021 (4)

- January 2022 (4)

- February 2022 (4)

- March 2022 (4)

- July 2022 (4)

- September 2022 (4)

- February 2023 (4)

- July 2023 (4)

- August 2023 (4)

- October 2023 (4)

- December 2023 (4)

- April 2024 (4)

- May 2024 (4)

- August 2024 (4)

- February 2025 (4)

- January 2026 (4)

- January 2012 (3)

- December 2012 (3)

- March 2013 (3)

- August 2013 (3)

- November 2013 (3)

- February 2014 (3)

- April 2014 (3)

- May 2014 (3)

- December 2014 (3)

- February 2015 (3)

- April 2015 (3)

- September 2015 (3)

- November 2015 (3)

- December 2015 (3)

- March 2016 (3)

- April 2016 (3)

- August 2017 (3)

- October 2017 (3)

- October 2018 (3)

- January 2019 (3)

- February 2019 (3)

- October 2019 (3)

- February 2020 (3)

- August 2020 (3)

- October 2020 (3)

- November 2020 (3)

- December 2020 (3)

- March 2021 (3)

- July 2021 (3)

- August 2021 (3)

- September 2021 (3)

- August 2022 (3)

- December 2022 (3)

- January 2023 (3)

- March 2023 (3)

- April 2023 (3)

- May 2023 (3)

- January 2024 (3)

- March 2024 (3)

- June 2024 (3)

- September 2024 (3)

- November 2024 (3)

- January 2025 (3)

- August 2025 (3)

- February 2026 (3)

- July 2011 (2)

- September 2011 (2)

- November 2011 (2)

- February 2012 (2)

- December 2013 (2)

- February 2017 (2)

- July 2017 (2)

- September 2017 (2)

- May 2018 (2)

- August 2018 (2)

- September 2018 (2)

- March 2019 (2)

- December 2019 (2)

- March 2020 (2)

- July 2020 (2)

- February 2021 (2)

- May 2021 (2)

- June 2021 (2)

- October 2022 (2)

- June 2023 (2)

- September 2023 (2)

- November 2023 (2)

- May 2025 (2)

- March 2010 (1)

- May 2011 (1)

- August 2011 (1)

- October 2011 (1)

- December 2011 (1)

- March 2012 (1)

- January 2014 (1)

- January 2018 (1)

- April 2018 (1)

- June 2018 (1)

- July 2018 (1)

- November 2018 (1)

- April 2019 (1)

- July 2019 (1)

- November 2019 (1)

- January 2020 (1)

- September 2020 (1)

- November 2021 (1)

- December 2024 (1)